A WIDELY EXPECTED STATUS QUO: RBI MONETARY POLICY: AUGUST 2024

Mutual Fund

Concurrent to our view, in its third policy of FY25, the Reserve Bank of India (RBI) retained a pause on interest rates for the ninth consecutive time. With headline inflation above the 4% target, the central bank governor persisted with its withdrawal of accommodation stance. However, two members voted for an interest rate cut, while four remained in favour of a pause. The RBI retained GDP growth for FY25 at 7.2% and its inflation target at 4.5%. The central bank added that it expects inflation to fall due to favourable base effects in the near term and it will remain vigilant to the evolving outlook. It also emphasized the rupee’s outlook, noting that despite the currency’s relative stability over the past few months due to a strong external sector, recent geopolitical developments and the unwinding of carry trades have led to its short-term weakening.

Policy Decision

- Repo rate unchanged at 6.5%

- SDF rate unchanged at 6.25% and MSF rate unchanged at 6.75%

- Four members voted in favor of the pause, while two members voted for an interest rate cut

- Four members voted to “remain focused on withdrawal of accommodation to ensure inflation progressively aligns with the target, while supporting growth”

Our view on RBI’s stance

We believe that the central bank’s cautious stance is based on three key factors

- Rising geopolitical uncertainty and global turmoil in last few days which can impact financial conditions and currency

- Uncertainty on monsoon and higher food inflation; RBI may want to ensure that rise in food inflation is transient before being dovish on monetary policy

- Outcome of Fed policy actions in September

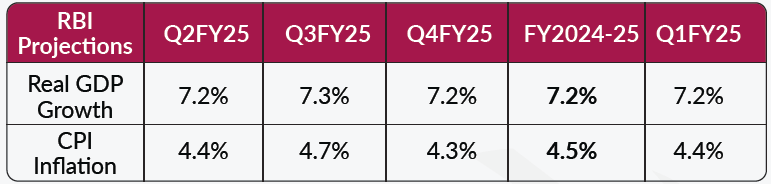

Growth estimates remain steady, inflation forecasts increased in near term

The MPC noted that the outlook for domestic economic activity remains robust given strong domestic demand and a resilient macroeconomic environment. Expectations of La Nina and rising reservoir levels coupled with better kharif sowing would lead to better rural consumption. Furthermore, urban consumption remains steady and sustained momentum in manufacturing and services could help a revival in private consumption. High frequency indicators of investment activity as evident in strong expansion in steel consumption, high capacity utilisation, healthy balance sheets of banks and corporates, and the government’s continued thrust on infrastructure spending, point to a robust outlook. The central bank raised the inflation targets for the near term while holding all other targets steady. Food prices do remain a concern for the central bank.

Source: RBI Governor’ Statement dated 8th August 2024

Global economic outlook

The RBI noted that global economic outlook remains uncertain and the pace of growth has been moderating. Inflation is retreating in major economies but services price inflation persists. International prices of food, energy and base metals have eased since the last policy meeting in June. With varying growth-inflation prospects, central banks are diverging in their policy paths with rates already been lowered by Canada, Switzerland and Europe and expectations of rate cuts by US and the UK. Given the weakening activity in the US, interest rate futures are pointing to 100-125 bps of rate cuts by December 2024.

Market Reaction

Market reaction was muted given the status quo and lack of mention of OMO sales or any other liquidity measures. Money markets have broadly remained unchanged with no meaningful movement in yields across the curve. The central bank noted that banking liquidity moved to surplus in July leading to an easing of overnight funding rate.

Our View

Policy commentary is in line with our view. The RBI is comfortable with the inflation trajectory due to expectations of favourable base effects and moderation in food prices if monsoon improves. Growth has been strong and the external sector outlook remains robust given our forex reserves of US$675 bn.

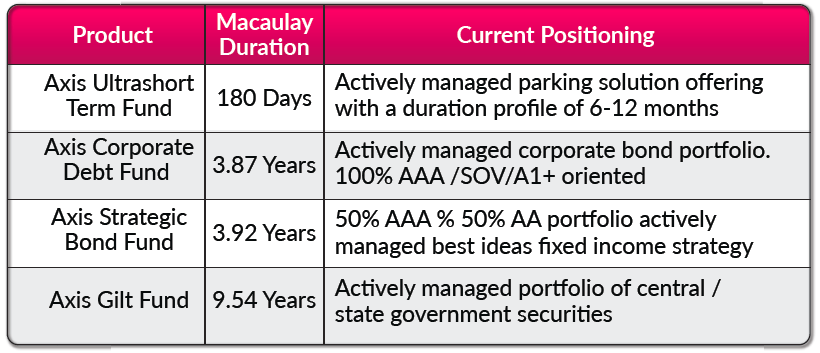

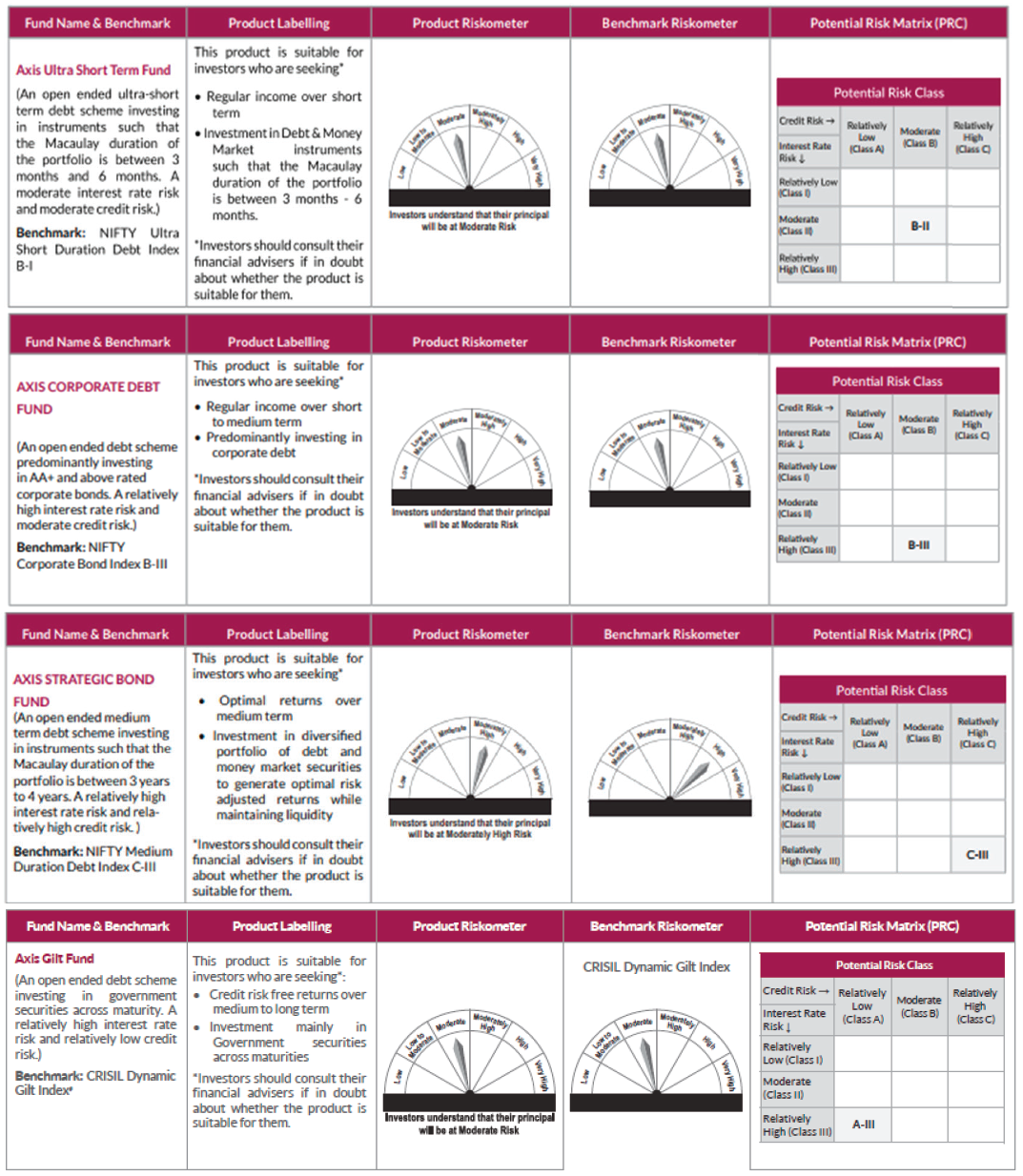

We believe that if monsoons are on track and food inflation subsides, there is very high probability of RBI changing its course on monetary policy from October. We expect the central bank to deliver about 50 bps of rate cut in this rate cycle and advise clients to remain long duration in their portfolio.

Risks to our view

- A depreciation in rupee could prompt RBI to be on a cautious mode delaying rate cuts

- Geopolitical risks can cause a flare up in crude oil prices and the Fed could be slower in lowering rates leading to a rise in bond yields

- Elections in the US could lead to volatility in bond yields

Allocation and strategy is based on the current market conditions and is subject to changes depending on the fund manager’s view of the markets. Data as on 31st July 2024

DISCLAIMER

Source of Data: RBI Monetary Policy dated 8th August 2024, Axis MF Research

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025